Between 2017 and 2018, the U.S. homebuilding industry grew by 0.85%, and from 2018 to 2019, it more than doubled its growth rate, increasing by 1.8%. As the U.S. entered 2020, no one could have expected what was to come. With the pandemic making its debut early in the year, there was an almost instant increase in demand for single-family homes. Coupling that demand with record-low mortgage rates created an environment well-suited to the homebuilding industry, and the growth rate soared to 5.97%. In 2020, the U.S. homebuilding industry closed out the year with an industry market value of $105.1B.

This growth, however, did not come without substantial challenges. Shutdowns and social distancing measures, significant labor shortages, supply-chain disruptions, and rising costs for many home building materials, especially lumber, all created unique barriers that those in the industry have had to learn to navigate.

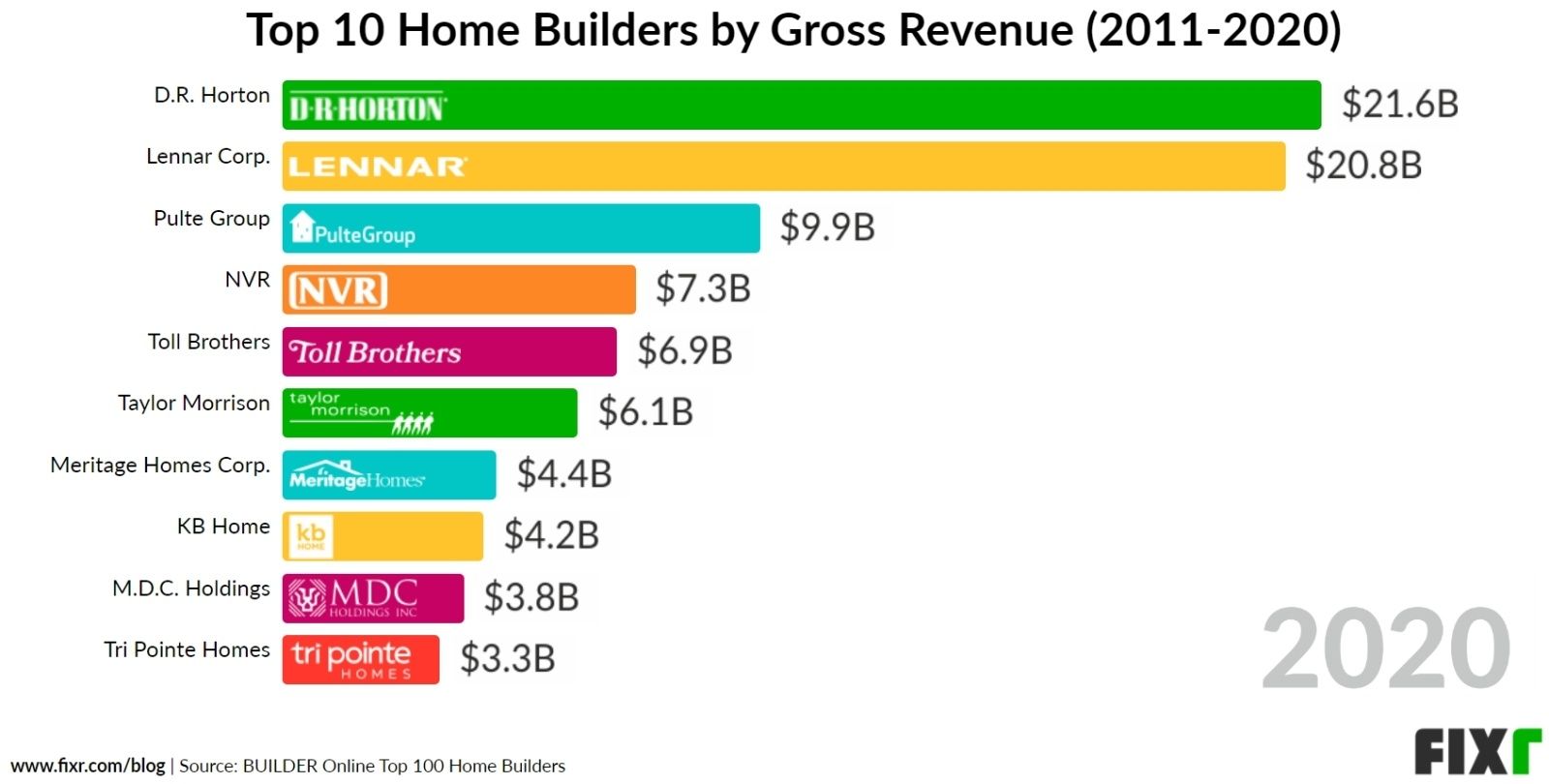

This article explores the major players in the homebuilding industry over the past 10 years by examining data from Builder 100. We compare these top companies based on their annual gross revenue, which is a measure of their total sales over the course of a year and does not take into account any operating costs or overhead expenses.

In the bar race chart above, the annual revenue at the close of year is shown for the top 10 home builders across the United States. As the years progress, revenues grow at different rates, and companies shift as they aim for the coveted top spot.

Biggest Home Builders Since 2011

Since 2011, the top 10 homebuilding companies have shifted among 18 different firms. Out of those 18, six have consistently held a spot in the top 10.

D. R. Horton has maintained the top spot for six of the past 10 years. From 2011 to 2012 and again from 2018 to 2019, they held the number two spot. Lennar Corp. comes close to D.R. Horton. They moved up from the third spot in 2011 and 2012 and have managed to maintain either the first or second spot for the last eight years.

Pulte Group began the decade in the top spot for both 2011 and 2012 but has since fallen to, and held, the third spot in the ranking. Both D.R. Horton and Lennar Corp. have pulled ahead significantly, each holding about 24% of the top 10 revenue share, while Pulte Group holds only 11.22%.

Market Share and the Industry

In 2020, the top three companies accounted for over half (59.23%) of the total revenue among the top 10 companies. Historically, these three companies were around the 50% mark, ranging from 49.7% to 53.16% between 2011 and 2017. However, beginning in 2018, they began pulling ahead strongly, with their share of the revenue jumping and increasing annually (57.7% in 2018 and 58.83% in 2019).

These three companies are growing their revenues at different rates. D.R. Horton and Lennar Corp. appear to have healthy growth and continue leading the pack. However, the same cannot be said for Pulte Group, which experienced a very small (1%) growth from 2018 to 2019 and, for the first time in a decade, had a revenue loss of 0.01% from 2019 to 2020.

For the smaller companies, some continued upward growth while others like KB Home and Toll Brothers experienced some revenue loss between 2019 and 2020 (-8.18% and -3.97%, respectively).

While there is no way to determine exactly what caused these decreases, it could have been due to the unique challenges companies faced this year, a tighter market due to the increased power and market share of the top two players, internal company policies, or a mix of all.

Top Home Builders in the U.S. in 2020

This year has been difficult for people and companies alike. But many of the homebuilding companies have fared quite well, with D.R. Horton and Lennar Corp. maintaining their lead in the industry. Taylor Morrison ended the year in the sixth spot. However, they had significant revenue growth of 32.58% from 2019 to 2020 (up from 12.35% and 5.51% the previous two years). Their growth was the highest of the top 10 companies.

Even with the crises that companies faced, including the material crisis that limited the ability to build even with a healthy crew available, they marched on and fared well. The companies that maintained that top 10 spots in 2019 were the same as those in 2020. As mentioned above, three companies experienced revenue losses this year instead of growth.

2021 projections for the homebuilding industry revenue values are estimated to grow at 7.7%, but how each company continues to navigate the ongoing challenges will determine if they will own a piece of that increase. Since it is expected that supply shortages will continue into the next year and maybe longer, companies should be keen to adapt so that they may continue their revenue growth.