The housing market has had its fair share of ups and downs over the years. Internal and external factors from the foreclosure crisis of 2010 to an inventory shortage just four years later have led to major swings in the market.

As the housing market has reacted to these events, so has the remodeling market, which tends to follow most ups and downs in the housing market. But the indexes for both the housing and remodeling markets have taken a nosedive in the first quarter of 2020 in a reaction to the coronavirus and its impact on the economy. Builders in particular have felt the impact of this dive, which may lead to more uncertainty for both markets in the future.

In order to understand how the market may be able to rebound, it’s important to look at how it has reacted in the past. Below, you’ll find graphics for both the housing market index and the remodeling market index, which details the trends that these two markets have taken up to and including the most recent market slowdown.

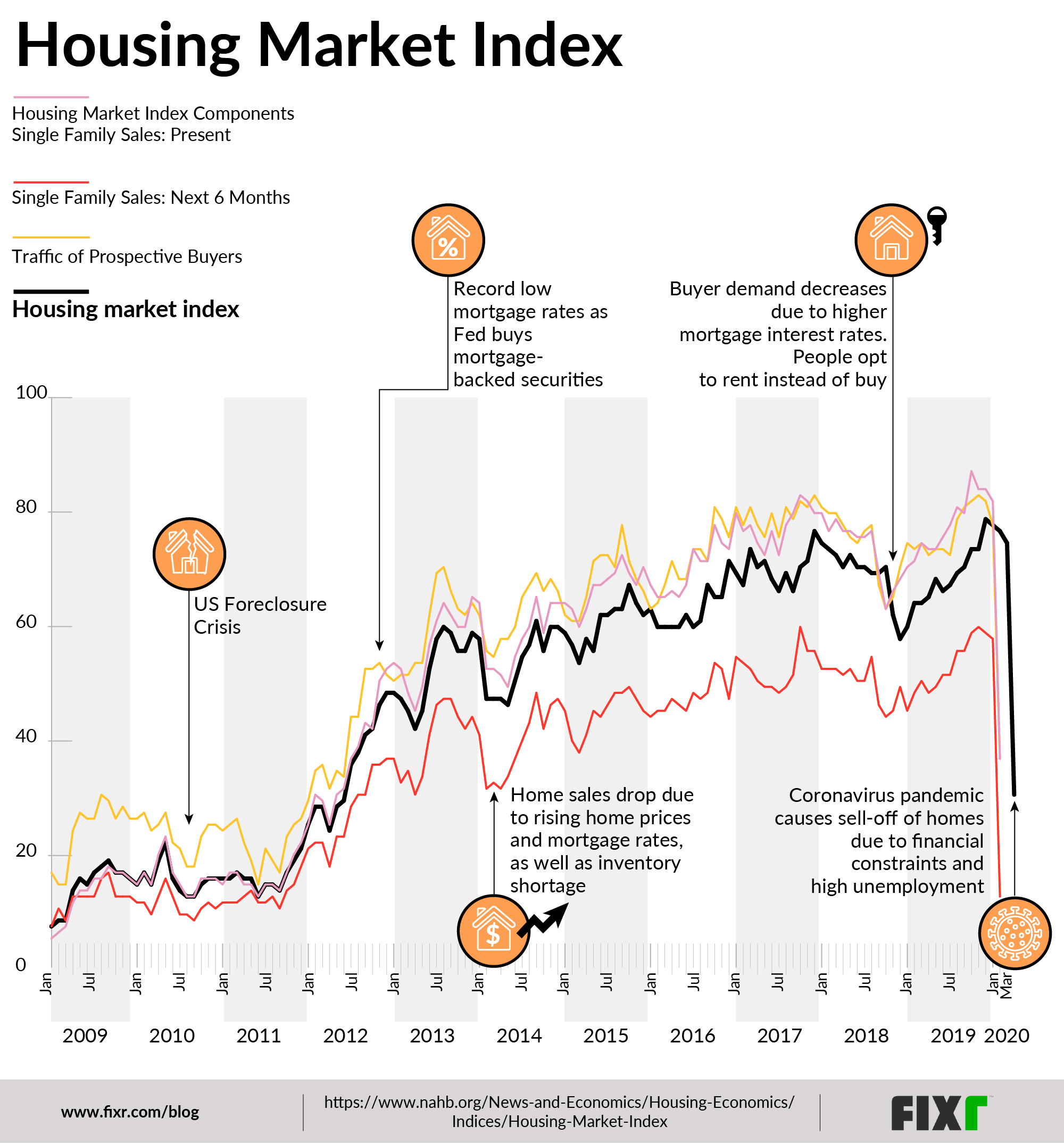

What Is the HMI?

The Housing Market Index is put out by the National Alliance of Home Builders and Wells Fargo. It tracks the performance of the housing market by rating the conditions for sales of homes in the present and in a forecast for the next six months.

As you can see from the graphic above, the market is far from static; it rises and falls over time, particularly when influenced by specific events such as the foreclosure crisis of 2010, or more recently when mortgage rates rose and more people opted to rent in 2018. Most recently, however, is the industry impact from the novel coronavirus. As homeowners felt the economic pressure of the crisis, they began to sell their homes in an attempt to alleviate financial strain. This led to too many homes on the market, and not enough buyers as most prospective homebuyers are waiting due to their own financial uncertainty for the future.

Examining the Housing Market Trends

When you view the index, it’s important to take note not only of the events that are causing the ups and downs of the market, but also of the different components. In the graph, you’ll see not only the market index, but also the state of sales at that moment, the forecast for the following six months, and the traffic of prospective buyers. It’s easy to see how the three are linked, with few variations in their trends up and down together. At the moment, all three have fallen sharply in a crash that appears to be taking numbers back to the lows of 2010.

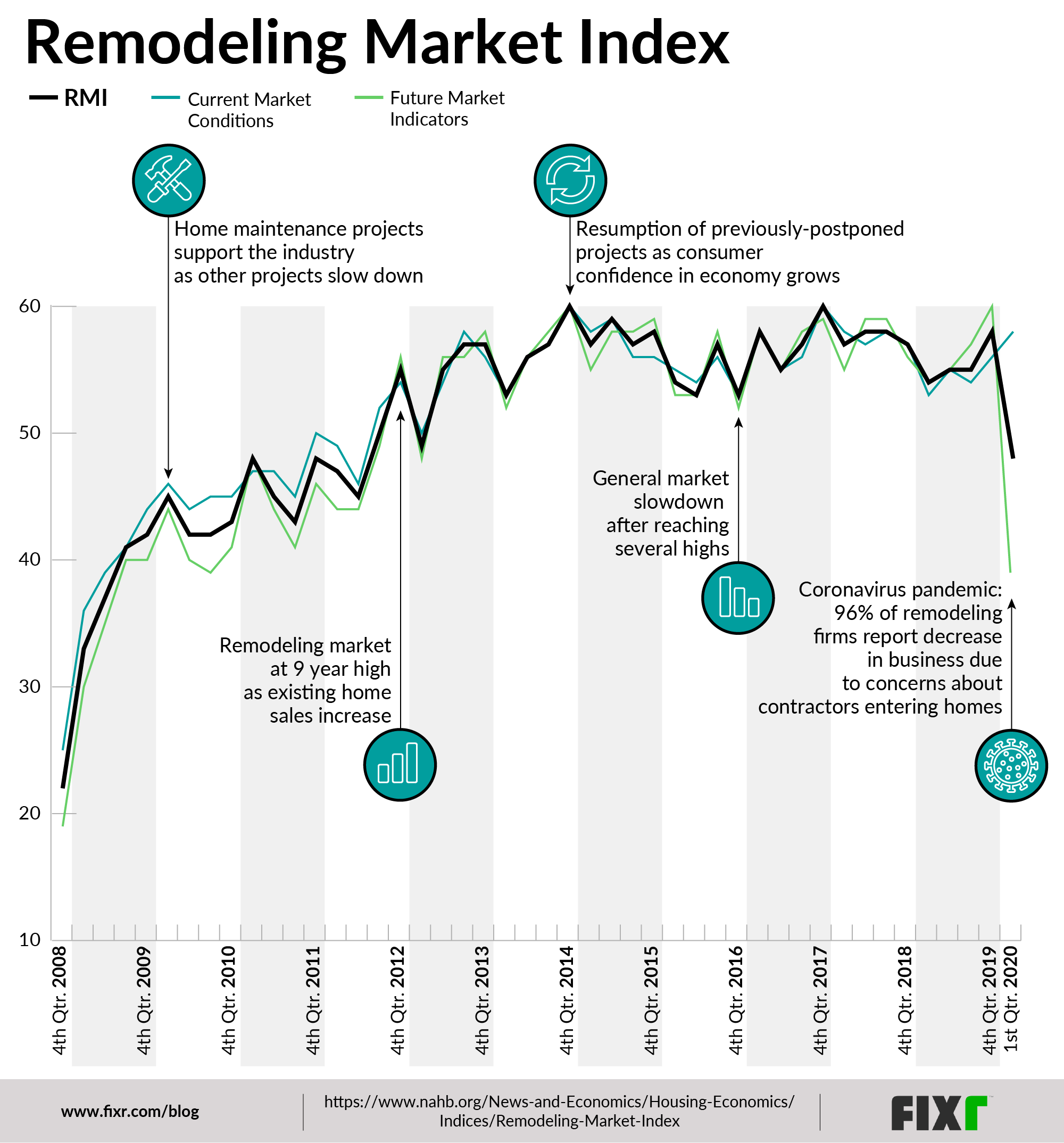

What Is the RMI?

When examining the HMI, it’s important not to overlook its corollary - the Remodeling Market Index. This data, gathered by the National Association of Home Builders, tracks the movement of the remodeling market quarterly, taking a snapshot of both current market conditions and future predictions over the next 6 months.

When the housing market changes, many people view this as a time to invest in their current properties, which means that whether the housing market does well or poorly, the remodeling market tends to experience a bump or at the very least, remains constant. This is true when the market slows, and people choose to turn their attention to their current homes, and it holds true when the market rises, and people choose to begin hiring contractors to work on their new homes.

Even when the market slows, it tends to remain optimistic for the future, with predictions generally bearing out towards an upward trend.

Watching the Remodeling Industry

While the remodeling market has certainly seen some ups and downs, it’s highs and lows don’t typically mirror the housing market’s trends exactly. This makes it important to view the industry on its own, as well as in conjunction with the other market.

As you can see from the graphic, current and future market conditions never differ vastly from one another, but often feed into each other over time. This makes it interesting to note that while the market has seen a steep decline with the current economic crisis, current market conditions are significantly higher than future predictions. This could be because contractors are currently working on jobs already underway, while new calls and prospective projects have fallen off sharply.

Given that the remodeling industry has seemed to rebound before the housing market in other downturns, it may be that the remodeling market may be the index to watch as states begin to slowly reopen and the economy begins to right itself.

Comparing Coronavirus Crisis to Others

What makes this particular dip in both the HMI and the RMI unique is that it’s a completely new crisis to arise since tracking of the markets began. While housing has always had ups and downs, and the remodeling market has always reacted to that, today’s crisis is unlike anything that has been seen before, impacting not only the housing market, but casting uncertainty over the future of the stock market and general economy as well. Because this type of crisis has never occurred, no one is able to predict exactly how big the total economic fallout may be or how much it may eventually impact the housing and remodeling markets.

The only way to make guarded predictions is to take a look at past events that have impacted the markets in the past. For example, the predicted future index for the housing market is as low as it was during the foreclosure crisis of 2010, and the current drop is much greater than what is being seen in the remodeling market. This tends to hold true with past events; the remodeling market tends to stay stronger as more people choose to invest in their homes. The remodeling market index did not drop during the last quarter, which makes sense considering the uncertainty. Most people with projects underway would want to complete them, rather than living through both an uncertain economy and timeline, and through the uncertainty of a half finished remodeling project.

At the same time, with more people staying at home than ever before, many people may choose to continue investing in their homes. Only waiting and watching the market will tell exactly how it may proceed in the future.

Track the Market Trends

There is still a lot of uncertainty in the country as things begin to open up and restrictions ease. Paying attention to the indexes can tell you a lot about not only the current state of the market, but also where it may be heading. Make sure you stay informed to see where the markets are leading, to ensure you can make the right decisions going forward about your business or about your property.